Insurance policy insurance policies are a crucial component of recent lifetime, giving security and relief in an unpredictable world. Irrespective of whether it's for your own home, automobile, overall health, or daily life, insurance policies insurance policies can offer fiscal security in the event of an unanticipated occasion. But just what are insurance plan policies, and why do we need them? This article will discover different facets of insurance plan insurance policies, breaking down their sorts, Gains, and importance in a method that's simple to be aware of. When you are new to coverage or just searching for a refresher, this manual will assist you to navigate the whole world of insurance policy insurance policies with self esteem.

At its Main, an insurance policies coverage is really a contract between you and an insurance provider. The insurer agrees to offer monetary coverage for certain pitfalls in Trade for normal payments referred to as rates. In other words, you shell out a set amount of cash on the insurance company, and so they guarantee to help cover the price if one thing goes Erroneous. Consider it like having to pay a small rate to prevent a A great deal larger economic burden Later on.

Facts About Insurance Policy Solutions Uncovered

Probably the most prevalent forms of coverage guidelines is auto insurance plan. Automobile insurance coverage can help include The prices connected to incidents, theft, or damage to your auto. In some instances, it can also supply legal responsibility coverage, safeguarding you if you're at fault in a mishap that damages somebody else's residence or results in injury. Devoid of auto coverage, a straightforward fender-bender could turn into a monetary nightmare, leaving you with high priced mend bills and clinical fees.

Probably the most prevalent forms of coverage guidelines is auto insurance plan. Automobile insurance coverage can help include The prices connected to incidents, theft, or damage to your auto. In some instances, it can also supply legal responsibility coverage, safeguarding you if you're at fault in a mishap that damages somebody else's residence or results in injury. Devoid of auto coverage, a straightforward fender-bender could turn into a monetary nightmare, leaving you with high priced mend bills and clinical fees.Homeowners coverage is another important plan for homeowners. Such a insurance coverage guards your own home and private belongings in opposition to damages caused by such things as hearth, storms, or theft. If a little something happens to your property, homeowners insurance policies will help purchase repairs or replacements. Additionally, it typically handles liability, so if someone is wounded on your own residence, you will not be still left footing the health-related expenses. Without having this sort of coverage, you can experience money destroy following an regrettable function.

Health insurance procedures are perhaps the most important form of insurance plan for people and family members. Healthcare costs can speedily include up, and without overall health insurance policies, Lots of people will be unable to afford to pay for vital treatment plans. Health and fitness insurance will help deal with the cost of doctor visits, hospital stays, prescription medications, and preventive treatment. It also can offer money safety versus surprising medical emergencies, like mishaps or critical ailments, which could usually drain your discounts or put you in financial debt.

Everyday living insurance policy is yet another crucial policy, especially for individuals with dependents. Life insurance plan makes sure that your family and friends are monetarily supported from the party within your Demise. The policy pays out a lump sum to the beneficiaries, which could help deal with funeral fees, pay off debts, or deliver profits replacement. Although it will not be one of the most enjoyable subject to think about, owning existence insurance coverage can provide comfort being aware of that your family are going to be taken care of, even when you're no more close to.

For many who individual a business, small business insurance plan policies are necessary. These insurance policies secure towards economical losses connected with such things as residence damage, employee accidents, or lawsuits. Depending upon the form of enterprise, unique insurance plan policies may very well be wanted. For example, a small small business owner may possibly need to have typical legal responsibility insurance, even though a company within the Health care sector could demand specialized protection like malpractice insurance coverage. Irrespective of the business, acquiring the correct enterprise insurance policies ensures that you're lined in the event of unexpected gatherings.

Whilst coverage policies are meant to protect us, they can be complicated. There are numerous differing types of protection, each with its possess principles and restrictions. Some insurance policies are required, like automobile insurance, while others, like life coverage, are optional but highly proposed. Being familiar with the stipulations of your respective plan is essential to ensuring you happen to be adequately guarded. Normally browse the high-quality print prior to signing any insurance plan deal in order to avoid surprises in the future.

Premiums can be a critical ingredient of any insurance coverage coverage. Rates are the amount you shell out to keep up your insurance coverage protection. They could vary widely determined by components like your age, health, the sort of coverage you may need, and also your claims historical past. For instance, younger drivers commonly pay out bigger rates for car insurance plan because of their lack of experience guiding the wheel. Similarly, an individual by using a history of medical situations may well encounter better rates Get started for health coverage. Purchasing close to and comparing estimates from different insurers can help you find the finest deal.

Besides rates, coverage procedures typically feature deductibles. A deductible Learn the truth is the quantity you must fork out outside of pocket ahead of the insurer starts off masking fees. As an example, if your car insurance has a $500 deductible, You will need to pay the first $five hundred of any restore prices your self. Deductibles are usually increased for guidelines with decrease rates, so it's important to locate a harmony that actually works for the funds. The decreased the quality, the higher the deductible, and vice versa.

Promises are A vital Section of the insurance method. When some thing goes Erroneous, you file a assert using your insurance company to ask for compensation for your reduction or hurt. The insurance provider will then assess your situation and identify whether or not the declare is legitimate. Should the assert is approved, the insurance provider pays out a percentage of The prices, minus any deductible. It's important to maintain in depth documents and documentation, such as receipts or images, to aid your claim and make certain a smooth procedure.

Coverage guidelines generally have exclusions, which happen to be situations or occasions that are not included through the coverage. By way of example, several car insurance policy insurance policies Never go over harm attributable to purely natural disasters like floods or earthquakes. Equally, wellbeing insurance policies might not protect certain elective processes or treatment options. It's necessary to comprehend the exclusions in the policy so you don't assume you might be coated when you're not. In case you are Doubtful, speak with an insurance plan agent or broker who will make clear any ambiguities.

Another thing to remember when buying insurance plan is the cheapest alternative isn't always the very best. Though It really is tempting to go together with a minimal-Value policy, It can be vital to consider the protection it provides. Occasionally, a lower quality may well indicate much less complete protection, leaving you exposed to economic dangers. Alternatively, a dearer coverage could offer a lot more substantial security and comfort. Always weigh the advantages and drawbacks of different guidelines before making a decision.

8 Easy Facts About Insurance Financial Solutions Explained

When thinking about an insurance policy plan, it's also significant to think about your prolonged-phrase needs. For instance, for anyone who is obtaining life insurance coverage, you'll want to pick a policy that can provide sufficient coverage throughout your daily life. In the same way, if you're paying for well being insurance plan, be certain the approach will protect any likely health care needs while you age. Insurance coverage requirements can modify over time, so It truly is a good idea to critique your insurance policies routinely and make adjustments as desired.Besides common coverage policies, There's also specialised kinds of insurance plan for market situations. For illustration, travel insurance policy can protect you if anything goes Incorrect throughout your excursion, for instance a flight cancellation or shed baggage. Pet insurance is an additional popular choice, encouraging pet entrepreneurs address the cost of veterinary charges. These specialized procedures supply reassurance for unique aspects of lifestyle, making sure you happen to be secured regardless of the occurs.

Understanding the part of an insurance policy agent or broker may aid simplify the process of deciding on the ideal policy. An insurance policy agent represents a single insurance company and may supply guidance over the guidelines they sell. A broker, on the other hand, performs with various coverage companies and can help you Look at selections from various vendors. Both of those brokers and brokers can support you find the proper protection for your preferences, whether You are looking for auto, household, well being, or everyday living insurance plan.

A different vital aspect to contemplate When selecting an insurance policy policy would be the insurance company's standing. Not all insurance policy organizations are established equivalent, and a few are known for giving far better customer support or quicker claims processing than others. In advance of committing to a plan, go to the trouble to study the insurance company's popularity. Look at client opinions, scores from independent companies, and any grievances filed with regulatory bodies. A highly regarded insurance provider offers you self esteem that you are in superior palms.

When you navigate the entire world of coverage, it's important to bear in mind insurance policies is Find more info ultimately about guarding you plus your family and friends. Even though it might seem like an needless price from time to time, acquiring the best insurance plan coverage can protect against a economical disaster within the occasion of an accident, sickness, or catastrophe. The relief that includes being aware of you happen to be coated is priceless. So, go to the trouble to be aware of your choices, Look at guidelines, and choose the coverage that most accurately fits your needs. In fact, insurance plan is undoubtedly an investment with your long run safety.

The 2-Minute Rule for Insurance Pricing Solutions

In conclusion, insurance policy guidelines are An important portion of modern existence, offering fiscal safety in opposition to the uncertainties that arrive our way. From car insurance policies to daily life insurance policies, and everything between, Every single policy performs an important role in safeguarding our perfectly-becoming. Whether or not you are a homeowner, a business operator, or perhaps a person searching to safeguard Your loved ones, getting the right insurance coverage protection will make all the difference. So, Do not wait for catastrophe to strike – ensure you're included today!

Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Marcus Jordan Then & Now!

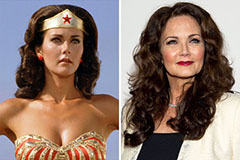

Marcus Jordan Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!